Wall St. Exec at Firm Used By Oregon PERS Under Wheeler is Arrested for Fraud

Monday, March 28, 2016

Ted Wheeler, Oregon PERS used Caspersen's firm

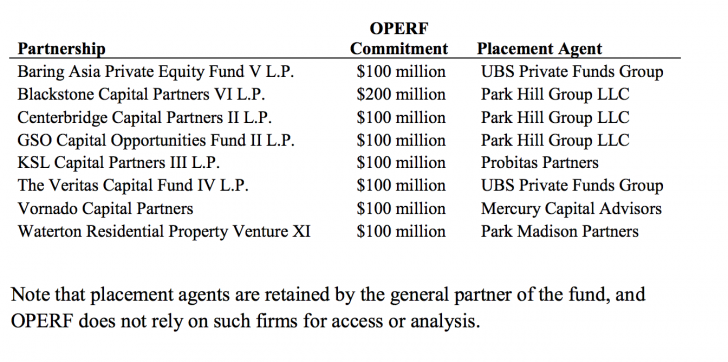

Oregon PERS used Park Hill Group for the placement of $400 million according to the January of 2011 filings. “Annual Disclosure of Placement Agents January 28, 2011, Purpose In accordance with OST Policy 5.03.01, Conflict of Interest and Code of Conduct: Staff shall present to the OIC an annual summary of any Placement Agent used by any investment firms, recommended to the OIC for approval" discloses the Oregon PERS relationship.

Andrew Casperson, charged by Feds on Fraud Charges

Placement Agents Banned by Many States and Pension Systems

Many state pension systems around the country ban the use of placement agents. In January of 2015, “New York City Comptroller Scott Stringer said it was time to ban placement agents from doing business with the city’s $150 billion pension system. On Monday, he announced that the boards of the five pension plans concurred,” reported the business publication Crane’s.

The practice is considered at best unregulated and at worst the wild, wild west of Wall Street. Forbes contributor, Ted Siedle described the practice of private placements as:

Forget the old adage, “work smarter, not harder.” A decade ago the savviest Wall Streeters discovered a way to make millions doing no work at all.

You can’t “work” any smarter than that in my book.

Related Articles

- Wheeler’s Top PERS Private Equity Firm Has Earned $125M While Paying $30M SEC Penalty

- Wheeler’s Treasury Legacy Had High Costs Compared to Performance

- Wheeler’s Bios Over 20 Years - The Often Missing Banking Experience

- Did Wheeler Have an Ethical Obligation to Disclose His 10 Years of Banking & Investment Experience?

- Coming Thursday - How Has the Oregon’s PERS performed Under Wheeler’s Leadership

- COMING WEDNESDAY: Treasurer Ted Wheeler and Wall Street

- Can Jesse Cornett Challenge Ted Wheeler in the Mayor’s Race?

- Can Jules Bailey Challenge Ted Wheeler?

- Hales Flip Flops on Out of State Money; Wheeler Takes it Too

- Spotted in Portland: Charlie Hales and Ted Wheeler at Blue Collar Baking

- Scott Bruun: Ted Wheeler’s Wheel of Big Government Solutions

- Could Wheeler Be Vulnerable to a Challenge from the Left?

- Governor Brown Declares Drought Emergencies in Baker and Wheeler Counties

- COMING FRIDAY: Why Wheeler is Clinton and Bailey is Sanders

- BREAKING: Ted Wheeler Challenges Mayor Charlie Hales to 12 Debates

- Big Money Limits on Campaign Donations in Portland, But Wheeler Has Massive Lead in Cash

- Can Bailey Compete with Wheeler’s Fundraising?

- Hales Gets Blindsided as Former Mayor Katz, Potter and Adams Endorse Wheeler

- NEW: Hales Says Wheeler Should Focus on His Job in Salem

- Portland Mayor’s Race: Why Wheeler is Clinton and Bailey is Sanders

- NEW: Facebook Page Calls for Ted Wheeler to Run For Mayor of Portland

- Mayor Hales Started the Effort, Wheeler Wants to Keep it Going

- Hales, Wheeler Voice Support for Minimum Wage Increase

- Hales, Wheeler Split on Novick’s Gas Tax Proposal

- How Ted Wheeler Could Unseat Charlie Hales in 2016

- Is Ted Wheeler the New Sam Adams?

- Is Ted Wheeler Winning the Fundraising Battle Against Charlie Hales?

- 16 To Watch in 2016: Ted Wheeler

- NEW: Wheeler Slams Hales on Portland’s Rape Kit Backlog

- Who’s Hot and Who’s Not in Oregon Politics: Ted Wheeler, Charles McGee, Julie Parrish

- Who’s Hot and Who’s Not in Oregon Politics: Ted Wheeler, Tina Kotek, Loretta Smith

- Why is Ted Wheeler Speaking at Oregon Mayor’s Conference?

- Why is Wheeler Failing to Disclose His Ten Years as a Banker And Investor?

- Why No Challenger for Wheeler is Bad News for Portland

- Who Has the Upper Hand in a Debate: Charlie Hales or Ted Wheeler?

- Where is Wheeler’s Challenger?

- Wheeler Unveils New Homelessness Plan - Big Scope, No Budget or Timeline

- Wheeler to Challenge Hales in Race for Mayor of Portland

- Ted Wheeler Promises To Shelter All Homeless If Elected

- Ted Wheeler Looks More Like an Incumbent Than a Newcomer

- Ted Wheeler Calls for Kitzhaber’s Resignation

- Ted Wheeler Announces He’s Running for Mayor of Portland

- Ted Wheeler Comes Out In Support of St. Mary’s Students

- Ted Wheeler During the Gordon Gekko Era

- Ted Wheeler is Putting His Desk On the Corner of SE 79th and Stark From 4:30-6pm TODAY

- Wheeler Scores a Big Endorsement—Nick Fish

- Wheeler Takes Aim at Oregon DEQ for Arsenic & Cadmium Levels in SE Portland

- Wheeler Campaign Blasts Hales for “Mismanagement of City’s Growth”

- Ted Wheeler Signs Working for the People Pledge

- Wheeler Issues Statement on Gun Violence

- Wheeler Receives 11 New Endorsements

- Wheeler Says “I Know We Can Do Better” in Campaign Announcement Speech

- Wheeler Rolls Out Tenants’ Bill of Rights

Delivered Free Every

Delivered Free Every

Follow us on Pinterest Google + Facebook Twitter See It Read It