What Landlords Should Know Before Renting to a Marijuana Business

Wednesday, April 22, 2015

And with the legality of recreational weed, canna-business is sure to follow.

In January 2016, the Oregon Liquor Control Commission (OLCC) will start accepting licenses for four types of marijuana businesses: producer, processor, wholesaler, and retailer.

Already entrepreneurs are looking for the perfect spaces to launch new businesses.

“I’m seeing a large demand for commercial and industrial property in anticipation for 2016,” said Jacob Zahniser, attorney with Jordan Ramis PC, whose practice focuses on construction and real estate litigation. “I also expect to see a large increase in medical marijuana licensing as a ‘foot in the door’ to commercial licensing in 2016.”

A License is the Safest Bet

If you’re considering leasing a property to a canna-business, there are some legal underpinnings you should know as a landlord.

“With any business transaction, obviously you want to proceed with caution, and especially when you’re allowing someone to grow a federally controlled substance in your property,” said Amy T. Margolis, attorney with Emerge Law Group in Portland.

She stressed that as Oregon moves towards the business licensing of recreational marijuana next year, it’s important to deal with tenants who have the proper license.

“If you’re not dealing with an OLCC licensed cultivator, then you really want to deal with somebody who is at least following the medical marijuana rules.”

Other things to consider are a good credit score, no previous evictions, the usual. But a lot of it comes down to a landlord’s internal vetting process.

“You really do use – no pun intended – the smell test with these potential tenants,” continued Margolis, citing signifiers of a proper tenant as everything from good people skills to whether or not they have an attorney.

According to Jacob Zahniser, there are certain parameters a lease needs to address with a weed-based business.

At the very minimum, Zahniser suggests an early exit, or termination, in the event of law enforcement action. In addition, a detailed description of the permitted use of the property, a compliance with state rules and regulations, and insurance and indemnity clauses specific to a marijuana-related business.

Also, added Zahniser, “the landlord would be wise not to avoid including a percentage of tenant’s profits as a portion of the rent.”

A Legitimate Tenant

Philip, who declined to give his last name, manages Spot Properties LLC, which leases a small property to the Urban Farmacy medical marijuana dispensary in NE Portland.

He said his tenants are great, with no complaints. But Urban Farmacy was the only one out of 20 medical marijuana applications that made the cut.

“When you get into that realm there seems to be a higher level of people that that don’t have their organizational skills intact,” said Philip.

“I want to make sure the tenant has the right tools in the tool box to make a successful business,” he continued. “And also be able to tread lightly. There’s a lot of stigmatism with marijuana.”

Although Philip affirms he’s not a marijuana person, he said he would much rather rent to a marijuana-related business than a bar.

“I think marijuana is less impact, with less fighting and less weirdoes hanging out,” he said. “More people hang out outside of a hookah bar or a cigar bar than a marijuana dispensary, which is more of a boutique.”

But beyond the “mess” of bars or noise complaints from neighbors, Philip believes a marijuana business has a better chance of surviving than a pub or restaurant, where nine out of 10 fail.

The Right Kind of Property

Once OLCC applications for recreational marijuana start pouring in next year, landlords have to know which buildings are suitable for a canna-business.

The basic qualifications state that the building must be at least 1,000 feet from certain locations, like a school, with security features installed.

“Co-tenant perception should also be considered,” said Zahniser, “as other tenants in the building may not appreciate a marijuana-related business next door.”

Also, the owner or manager should consider the insurance on the building. If the marijuana-related business on the property alters the risk the insurance company agreed to, the business could void insurance coverage.

But perhaps most importantly, affirms Zahniser, the owner or manager should consider the impact on its bankruptcy rights.

“A landlord may not be able to seek bankruptcy protection if its tenants are in the marijuana business,” he said.

Who’s Afraid of the Feds?

The day the feds come knocking is a serious fear of some canna-business landlords.

In fact, a number of medical marijuana dispensaries in Portland declined to be interviewed for that very reason.

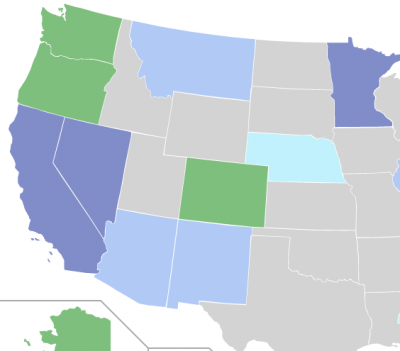

Although the Oregon Medical Marijuana Act was passed back in 1998, and Measure 91 is just around the corner, cannabis is still illegal under federal law.

But Amy T. Margolis says not to worry.

“I understand where the concern comes from. Those are big assets, and you might have your loan pulled… But I haven’t really seen a property forfeiture of a legal cannabis business for a very, very long time,” said Margolis.

She explains that federal law enforcement would have to be privy to knowledge that the landlord had gone beyond simply renting out the property, and was in addition aiding and abetting a criminal activity.

“We just don’t see that, almost at all anymore,” said Margolis.

One landlord who isn’t afraid is the property owner of Brooklyn Holdings Company, a prohibition-style “speakeasy” cannabis dispensary in SE Portland.

“I feel very confident because 23 states have medical marijuana, so it’s going to be real hard for the feds to eliminate that,” said Tom, who also declined his last name. “So I’m not that scared as to what the feds are going to do. I think they’d be pretty stupid to try to change that around.”

Tom said he would definitely rent to a recreational weed dispensary, as long as they follow the rules.

Margolis confirms, “I never ever tell landlords, no problem, no risk. But I do think as we move forward that risk has become substantially less.”

Related Slideshow: Ten Things to Know About Marijuana Legalization in Oregon

Here are ten things you need to know now that pot is legal in Oregon.

Related Articles

- Ten Things You Need to Know Now That Pot is Legal in Oregon

- Washington’s 7 Marijuana Legalization Mistakes Oregon Can Avoid

- MBank First in Oregon to Open Its Doors to Marijuana Industry

- Measure 91: Oregon Becomes Third U.S. State to Legalize Marijuana

- Marijuana Vote Will Be Close, Oregonian/KGW Poll Says

- Marijuana Legalization Ballot Measure Gets City Club Backing

Delivered Free Every

Delivered Free Every

Follow us on Pinterest Google + Facebook Twitter See It Read It