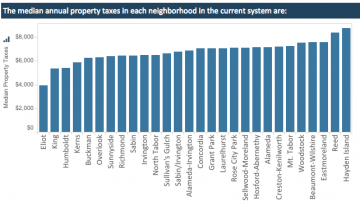

Portland Neighborhoods That Pay the Most and Least in Taxes

Thursday, November 13, 2014

The Multnomah County Auditor released a groundbreaking study and mapping tool last month, Inequities in Multnomah County Property Taxes, that lets you compare the property values of homes and what their owners pay in property taxes depending on their neighborhood.

“There are a lot of people getting hurt and a lot of people getting a substantial break,” Multnomah County Auditor Steve March said. March's office assembled the study.

See Slides Below: The Most and Least Taxed Neighborhoods

The online tool includes comparisons of Portland neighborhoods east of the Willamette river that have similar tax rates. The results are startling.

A house in Southeast Portland’s Brooklyn Neighborhood that costs $400,000 can pay up to $3,500 more in property taxes than a house of the same value in North/Northeast Portland’s Eliot neighborhood.

While in the past there’s been a lot of anecdotal evidence about disparities in Oregon’s property taxes system, shaped by the mid-1990s ‘cut and cap’ initiative Measure 50, no one has ever done a comprehensive property-by-property study of a large area until now, according to March.

Disparity Hurts First Time Homebuyers

“Buyers get blown away by their tax bills,” realtor Kyle Ball, from Mal & Seltz Real Estate Solutions, said of many first-time homebuyers. “Taxes are a huge deal for a lot of buyers.”

Ball and other brokers said the impact of tax disparity often falls on first-time homebuyers because they tend to gravitate to the east side of the city.

“First time homeowners are usually pretty clueless,” said Ball. “They think price is price is price about 80 percent of the times.”

That can be a shock when someone fails to take taxes into account. For example, a home costing $200,00 to $250,000, an affordable first home in the Portland market, would pay only $1,000 a year in taxes in Boise Neighborhood, but in Lents Neighborhood a house costing the same amount would pay out some $3,500 a year in taxes.

Gentrification and impacts on low income resident

In January of 2013, the Portland City Club, an urban policy thinktank, released its own study on the property tax inequities, Reconstructing Oregon’s Frankentax.

“The burden of the property taxes falls disproportionately on the people with low income and it contributes to gentrification,” Greg Wallinger of the Portland City Club said.

In inner North and Northeast Portland, home values have skyrocketed in the last 20 years, but that increased value is not reflected in the property taxes those homes produce. Instead tax revenues remain frozen at their approximate levels from the mid-1990s, when the area was suffering from high crime, disinvestments and redlining.

Tools: Use the interactive county site to compare taxes in your neighborhood

Now those homes fetch a premium because of their low property taxes and the neighborhood has rapidly displaced many of its old residents, moving from a black majority neighborhood to a white majority neighborhood in a decade.

March said if the reverse is also true, then poor neighborhoods will see less investment because of tax rates that punish new homebuyers.

“I know people love Lents,” said March. “But why would you buy a home there, when you can pay the same amount and be taxed less in Boise.”

One of the answers may be that there are't affordable homes left in inner neighborhoods like Boise, where tax discounts are deepest.

Legacy of Measure 50

Oregon’s property tax, and by extension it’s school funding system, was thrown into chaos in the mid-1990s by ballot Measure 47. The cut and cap measure was part of a voter-approved wave of anti-tax initiatives that rolled up and down the West Coast at the time, starting with California’s Proposition 13.

Later adjusted by the Oregon State Legislature and reapproved as Measure 50, the law capped the assessed value of all homes at their 1995 levels and only allowed for three percent assessment increases per year.

“I think the folks who put Measure 50 in place, their goals were admirable, but there have been some unintended consequences,” said Wallinger.

In places where values have increased radically since 1995, assessed value no longer bears any rational relationship to the marketplace.

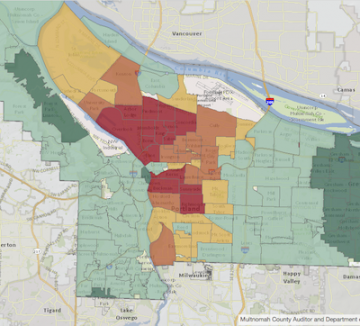

Proposal by Multnomah County Auditor shows a "revenue neutral" adjustment in property taxes. Neighborhoods in read and orange would see tax increases, green areas would see taxes decrease.

Meanwhile, California has adjusted the disruption caused by Proposition 13.

“In California, they adjust the assessed value of a home when it’s sold,” said March. “That seems fair, because the new buyer knows what they are getting into.”

The auditor’s report recommends atn “income neutral” adjustment, where under-paying properties would see their taxes rise, while over-paying properties would see their taxes fall. In the end, the same amount of taxes collect for the city as a whole would not change.

Leadership?

Democrats and Republicans have been at loggerheads for years over the issue, but Gov. John Kitzhaber said that a ‘grand bargain’ on tax reform was one of his fourth term goals.

Oregon GOP Chairman Art Robinson said Republicans generally accept the idea of tax reform that's revenue neutral if it produces more equanimity.

“The party doesn’t have a general view on this,” Robinson said. “But I think that taxes should be equitable and fair and in general Republicans just don’t like to see taxes increase.”

That said, and in perhaps a telling indicator of leadership on the issue, neither the office of Democratic House Leader Tina Kotek nor the office of House GOP Minority Leader Mike McLane returned repeated requests by GoLocalPDX for comment on the issue.

The Governor’s office also did not respond to requests for comment in time for publication.

Related Slideshow: Slideshow: Most and Least Taxed Portland Neighborhoods

Related Articles

- Portland’s Most Dangerous Neighborhoods

- Study Finds Largely Black Neighborhoods Less Likely To Gentrify

- SE Division St. Among 10 Hottest Food Neighborhoods in U.S.

- Project Brings Art To Far Flung Lents Neighborhood, For Now

Delivered Free Every

Delivered Free Every

Follow us on Pinterest Google + Facebook Twitter See It Read It