Oregon Pays Among the Highest Wall Street Pension Fees in US

Wednesday, August 05, 2015

Oregon’s state pension system - the Public Employees Retirement System - pays among the highest pension fee costs to Wall Street management firms in the country. Oregon ranks 5th among 33 state pension funds reviewed by the Maryland Policy Report.

Worse yet for Oregon’s system with the highest fees did not achieve high returns. As the report finds, “For the five years ending June 30, 2014, we were unable to find a positive correlation between high fees and high returns. In fact, we found a negative correlation.”

For Oregon retirees the impact of high fees may be disturbing as Wall Street scored more than $504 million in fees. Other than the California retirement system (CalPERS) and the Florida Retirement System, Oregon paid by far the most in Wall Street fees.

“This is not a glowing endorsement for Wall Street advice, reminding one of author Fred Schwed Jr’s critique of Wall Street, what he asked, 'Where are the customer’s yachts?’”

The other trend unveiled by the Maryland Policy Report was the shift by states to higher levels of investment in private equity and hedge funds.

“Private equity and hedge fund investments have been disasters for the states,” indicated John Walters, an MPPI fellow and report co-author. “Their underperformance was a surprising 5 percent per year, compared to relevant benchmarks, and it cost the states tens of billions in lost income.”

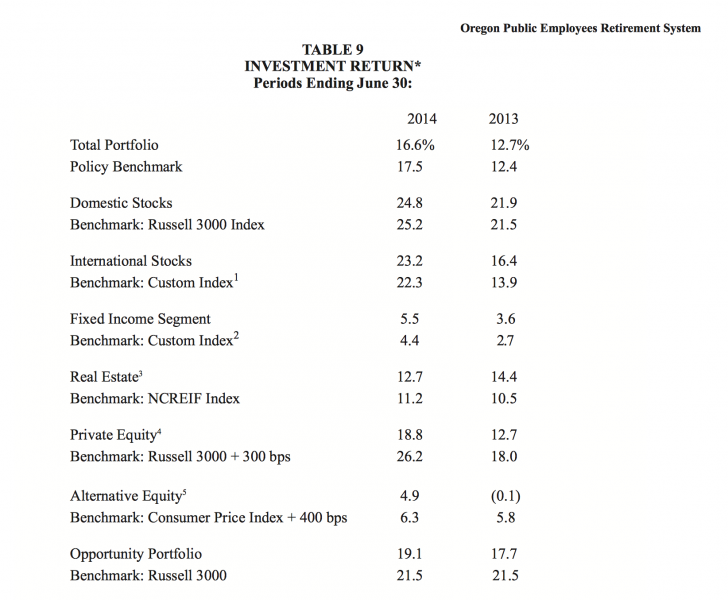

According to Oregon’s PERS’ annual report, the state increased private equity investment from 12.7% in 2013 by nearly 50% -- to 18.8% on the funds. Even more potentially concerning is that alternative equity investment (private equity) was increased from a tiny fraction of one-tenth of one percent to 4.9% of the fund.

Hedge-fund and hedge fund fees have come under criticism for their poor performance and high fees respectively.

“The Wall Street firms’ typical sales pitch is that they can out perform a given section of the market; therefore, the system should pay them a fee for their investing prowess,” said the report.

Pew Research reported that through 2013, Oregon had an unfunded pension liability of greater than $60 billion.

Related Slideshow: Oregon Business Rankings in US

See how Oregon stacked up against the other states in the U.S.

Related Articles

- Who’s Hot and Who’s No in Oregon Politics: Foster Youth Connection, Sonny Mehta, PERS

- Scott Bruun: Oregon’s Public Pension Catastrophe

- Kitzhaber Will Receive Full State Pension, Even If Convicted of Criminal Charges

- Kitzhaber Voted for Pension Bill in 1987 that Got Him 8 More Years of Benefits

- Personal Finance: What People with Government Pensions Should Know about Social Security

Delivered Free Every

Delivered Free Every

Follow us on Pinterest Google + Facebook Twitter See It Read It