Personal Finance: 5 Key Social Security Strategies For All

Wednesday, November 19, 2014

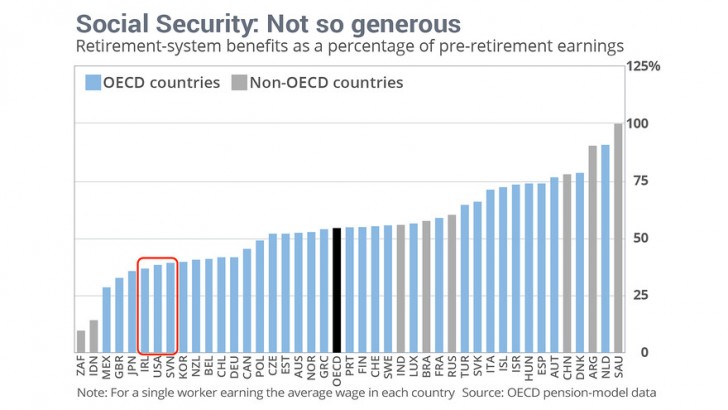

No one ever said you could live like royalty on Social Security. The program was always intended to provide a foundation for retirement but not to completely replace one’s working income. Social Security benefits are, in fact, quite modest as a percentage of pre-retirement earnings in comparison to the retirement systems of many other countries. For the average worker in the US, Social Security retirement benefits replace approximately 40% of pre-retirement income placing our retirement system squarely near the bottom worldwide.

Source: Center for Retirement Research at Boston College

In spite of the program’s relatively low level of benefits, it is wrong to ignore the importance of Social Security in developing a retirement strategy given two key advantages Social Security benefits have over most other sources of retirement income: guaranteed lifetime benefits and annual cost of living (COLA) adjustments. It therefore behooves us to do all that we can to maximize this benefit.

Yet, Social Security is a very complicated system comprised of myriad rules and regulations. It can be daunting to navigate these without a roadmap. While there is no replacement for working with an advisor familiar with the intricacies of the system, I’d like to offer the following 5 core strategies to help you avoid major mistakes managing your Social Security benefit.

1. Don’t Claim at Age 62

One can claim a Social Security retirement as early as age 62. In some cases this is the right choice, such as when an unmarried person has a short life expectancy. In most cases, however, taking benefits before full retirement age (FRA) is a mistake given that doing so results in a permanent benefit reduction. For someone whose FRA is 66, taking a retirement benefit at age 62 results in a 25% benefit reduction. This shortfall might not seem like a lot initially but its impact grows over time due to the effect of annual COLA adjustments. If, for example, one’s FRA retirement benefit at age 66 is $1,000/month, taking at age 62 reduces this to $750, a $250 reduction. Assuming an annual COLA of 2.8%, this difference grows to $472 ($1,415 versus $1,887) by age 85, and continues to grow the longer one lives.

2. Delay Taking Benefits to Age 70

The counterpoint to the benefit reduction that results from early taking is the credit earned for delaying the start of retirement benefits past FRA. For each year after FRA benefits are delayed, one can earn delayed retirement credits (DRC) of 8%. For the retiree whose FRA is 66, therefore, delaying to age 70 results in a 32% increase in benefits. If the FRA benefit is $1,000, the age 70 benefit will be $1,320, excluding COLA adjustments. The impact of DRCs is even more dramatic if we compare the delayed age 70 benefit to the early age 62 benefit for a retiree with a FRA of 66. The age 70 benefit with DRCs is fully 76% greater than the age 62 early benefit! Clearly, delaying past FRA yields significant additional lifetime income to those who take advantage of this strategy.

3. Maximize Strategies for Couples

The Social Security rules allow married couples (including legally married same-sex couples living in states that recognize gay marriage) various claiming options that can be utilized to great effect. These involve optimizing when spouses respectively claim spousal and retirement benefits in order to maximize lifetime cumulative income. These strategies are only possible after FRA.

Photo Credit: iStock

The “Take Some Now, Take More Later” strategy is another benefit maximization strategy available to spouses. In this scenario, the lower earning spouse files for his retirement benefit at FRA. This enables his spouse at her FRA to file a “restricted application” for a spousal benefit. The higher earner continues to receive the spousal benefit until age 70, at which time she switches to her own retirement benefit which has been maximized as a result of earning DRCs.

Deciding which of the above strategies yields the best result requires analysis and depends on the respective ages and FRA retirement benefits of the spouses. Given the lifetime income maximization opportunities these strategies present, it is important for spouses to plan ahead before reaching FRA to decide on the strategy that is best for their particular situation.

4. Know Your Options as a Divorced Spouse

Many divorced spouses are unaware that they may be entitled to spousal or survivor benefits on the record of their former spouse. The key criteria are whether the marriage lasted at least 10 years and whether the claimant spouse has remarried or not. Divorced spouse benefits are not available if the claimant has remarried. Survivor benefits are not available to a divorced spouse if she remarries before age 60 (or 50 if disabled). Note that while survivor benefits are available as early as age 60 (or 50) and spousal benefits at age 62, they will be reduced if taken before FRA.

Divorced persons, especially those whose former spouses were the high earners in the marriage, should contact SSA if they believe they qualify for benefits under the above rules.

5. Go Back to Work If You Need To

FRA retirement benefits are calculated using a formula that averages the highest 35 years of income earned over one’s working career. Many people, especially women who dropped out of the work force in whole or in part to raise a family, either do not have a full 35 years of earnings history or, even if they do, have years with relatively low earnings. That means that low or no-earnings years will be added to the 35 year average, ultimately resulting in a lower FRA benefit. Going back to work is a guaranteed way to increase your ultimate retirement benefit to the extent you can eliminate lower earning years from the benefit calculation.

Social Security is a complex system and the above is not meant as an exhaustive review of its intricacies. My hope is that by highlighting the above strategies, you will be able to see how they may apply to your specific circumstances and empowered to make better claiming decisions.

Readers with questions on personal finance and Social Security can email Joe Alfonso at [email protected].

Related Articles

- Personal Finance: Finding the Right Financial Adviser

- Personal Finance: Four Tips for Year End Tax Planning

- Personal Finance: How To Make Sure Your Retirement Portfolio Lasts As Long As You Need It To

- Personal Finance: Response to Reader Questions on Social Security

- Personal Finance: Smart Saving And The Magic of Compounding

- Personal Finance: The Social Security Safety Valve, How ‘File and Suspend’ Could Work for You

- Personal Finance: Understanding Social Security Spousal Benefits

- Personal Finance: What Older Divorcees Need to Know About Social Security

Delivered Free Every

Delivered Free Every

Follow us on Pinterest Google + Facebook Twitter See It Read It