Friday Financial Five – October 30, 2015

Friday, October 30, 2015

Consumers who are purchasing healthcare coverage through exchanges will find that their cost of coverage will be higher for 2016, as they begin to select health insurance plans this weekend. Premiums, as well as penalties for not purchasing insurance, will be increasing next year. The average cost increase for the “silver plan”, the second cheapest option on the federal exchange, will cost approximately 7.5% more next year according to the Department of Health and Human Services, with a projected 10 million people purchasing through the exchanges. To obtain coverage by January 1st, consumers will need to choose coverage by December 15th, 2015. For 2016, the penalties for going without coverage are $695 per adult, and $347.50 per child or 2.5% of family income (whichever is greater) with a maximum of $2,085 per household. The penalties for 2015 were $325 per adult, $162.50 per child, or 2% of income (whichever is greater) with a maximum of $975 per household.

Widowed Spouses and collecting Social Security Survivors Benefits

Anyone who is currently collecting social security benefits has a once in a lifetime opportunity to withdraw their application to receive benefits within the first 12 months of claiming them in order to claim a higher amount in the future. Does this same opportunity apply to widowers who have already claimed survivors benefits, but want to stop collecting in order to receive a larger benefit amount later on? The answer is yes, but there is no 12 month stipulation, according to the Social Security Administration. Surviving spouses are eligible to receive 100% of what their deceased spouse collected or was entitled to collect at the time of their death if surviving spouse is at least full retirement age. Survivor benefits are available as early as age 60, but benefits are reduced to 71.5% of the deceased workers benefit. An important factor to look into is that your full retirement age may be different than the age of eligibility to receive full survivors benefits.

China is now allowing couples to have 2 kids

Back in the 70’s, China instituted a “one child policy” to prevent overpopulation and stave off a threat to their nation’s resources. Since then, China’s explosive economic growth over the past few decades has led them to become the world’s second biggest economy. Now, they are faced with a demographic time-bomb: an aging population coupled with declining birth rates, which has produced a smaller pool of workers to draw from. The economic ramifications of this outdated policy will result in a holdback of growth in their economy while worker’s wages dramatically increase. Even worse, it may force leading companies to move their factories to other lower cost nations. On Thursday of this week, as China’s leaders met to hash out a 5 year economic framework, they ended their demographic experiment now allowing families to have 2 children in an effort to foster population growth.

Budget Bill passes the House to end key social security claiming strategies

Recently, congressional leaders crafted a bill that would end two popular strategies for couples claiming social security benefits. The strategies, known as “file and suspend” and “restricted application for benefits”, have provided tens of thousands of dollars to a couple’s lifetime income by allowing one spouse to claim as many as 4 more years of spousal benefits and collecting delayed retirement credits. Under the bill, anyone 62 or older this year will be able to file a restricted application at 66 or older to receive only a spousal benefit. For those younger than 62, the restricted application strategy will no longer be available. This may cause people who are nearing retirement and banking on utilizing this strategy to now either work longer, or tap into their nest egg sooner than expected. The bill, which passed the House on Wednesday and now moves to Senate, will take effect 6 months after the budget bill goes into effect.

Women, Divorce and Finances

We all hear that almost 50% of marriages end up in divorce. Some studies show that folks remain in a marriage long after it has broken down due to finances. Women are primarily affected by this, as they often take time off from their careers to raise family, re-enter the work force at lower paying jobs and miss out during their peak earning years in contributing to social security and their retirement plans. In addition, many women leave the financial decisions up to their husbands, and find themselves at a point of confusion when facing a divorce, and having to make key decisions during an emotional time. One of the up and coming trends in the financial services industry is the CDFA certification (Certified Divorce Financial Analyst). This specialist helps clients determine the most “equitable” division of assets and analyzes the various outcomes of a divorce proposal.

Jane McAuliffe is an Investment Advisor Representative at the firm Forbes Financial Planning, Inc in East Greenwich, RI and can be reached at [email protected]. Jane is also currently pursuing her CDFA certification.

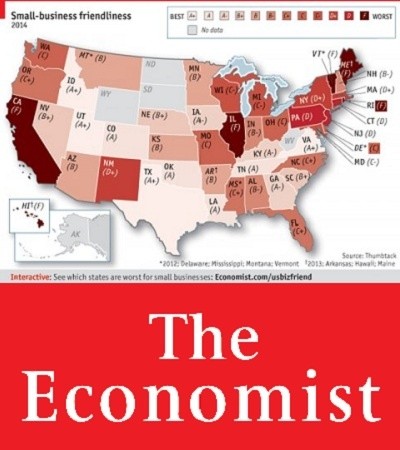

Related Slideshow: Oregon Business Rankings in US

See how Oregon stacked up against the other states in the U.S.

Related Articles

- Friday Financial Five – March 13th, 2015

- Friday Financial Five – March 20th, 2015

- Friday Financial Five – March 27th, 2015

- Friday Financial Five – June 5th, 2015

- Friday Financial Five – June 19th, 2015

- Friday Financial Five – July 31, 2015

- Friday Financial Five – July 3rd, 2015

- Friday Financial Five – June 12, 2015

- Friday Financial Five – March 6th, 2015

- Friday Financial Five – May 29th, 2015

- Friday Financial Five – October 9, 2015

- Friday Financial Five – September 18th, 2015

- Friday Financial Five- November 7th, 2014

- Friday Financial Five – October 23, 2015

- Friday Financial Five – October 2, 2015

- Friday Financial Five – November 14th, 2014

- Friday Financial Five – November 21st, 2014

- Friday Financial Five – November 28th, 2014

- Friday Financial Five – July 24, 2015

- Friday Financial Five – July 17, 2015

- Friday Financial Five – August 7th, 2015

- Friday Financial Five – December 12th, 2014

- Friday Financial Five – December 5th, 2014

- Friday Financial Five – April 3rd, 2015

- Friday Financial Five – April 17th, 2015

- Friday Financial Five - August 14th, 2015

- Friday Financial Five - August 21, 2015

- Friday Financial Five - September 24th, 2015

- Friday Financial Five – February 13th, 2015

- Friday Financial Five – February 20th, 2015

- Friday Financial Five – January 23rd, 2015

- Friday Financial Five – January 30th, 2015

- Friday Financial Five – July 10th, 2015

- Friday Financial Five – January 2, 2015

- Friday Financial Five – January 16th, 2015

- Friday Financial Five – February 27th, 2015

- Friday Financial Five – February 6th, 2015

- Friday Financial Five

Delivered Free Every

Delivered Free Every

Follow us on Pinterest Google + Facebook Twitter See It Read It