Friday Financial Five – November 13th, 2015

Friday, November 13, 2015

Gundlach still opposes a rate hike

Doubleline Capital’s Jeff Gundlach, considered by many to have assumed Bill Gross’ mantle as the leader in fixed income investment, doesn’t believe in a December rate hike. Aside from assessing that most bond managers aren’t ready for rise in rates, he made several other points against the Fed taking action. There is the absence of meaningful inflation, especially with the continuation of low oil prices. While the European Union continues economic stimulus, the U.S. would be cutting rates, a drastic disconnect between two regions with similar growth. Most important to Gundlach is the drop in the junk bond index, which is at four-year low.

Lew advocates for myRA

Jacob Lew, the Treasury Secretary, released a statement this week promoting the use of https://myra.gov/)" target="_blank">myRA as the “stepping stone” to greater savings. Workers may not have experience or options in terms of saving for retirement and some aren’t comfortable with investment markets they don’t understand. myRA provides a beginner’s experience for tax deferred savings for those that don’t have a retirement plan at work. As Lew points out, it’s a simple and safe way to begin the process of saving for retirement. It’s no longer feasible to think of Social Security as the sole source of retirement income.

House pushing a replacement fiduciary bill

Raising fiduciary responsibility for retirement account advisers remains a priority and the House of Representatives is working on a bill separate from the Department of Labor’s. While the House bill also requires advisers to work in the client’s best interest and disclose compensation and fees, it’s an effort to reduce the DOL bill’s negative consequences on low and middle income families. The fight will continue between those that want complete fiduciary responsibility and an industry that simply wants full disclosure.

Short window to file and suspend

‘File and suspend’ is the strategy for taking Social Security benefits where a higher earning spouse would file for benefits at full retirement age (FRA) and then suspend benefits to accrue retirement credits. The lower earning spouse subsequently claimed spousal benefits. This option is going away effective April 30, 2016 but remains an option to consider until then. Single people who are or will turn 66 within six months of November 2nd can also file and suspend at any point within that timeframe, once reaching full retirement age. This allows the banking of those benefits while earning roughly 8 percent annually until age 70, along with the option to request suspended benefits in a lump sum.

Fantasy sports companies on the ropes

Daily fantasy sports companies are in the New York Attorney General’s crosshairs, with Draftkings and FanDuel receiving a cease-and-desist order to halt operations in the state. Furthermore, Marketwatch reports major financial institutions may wash their hands of the companies altogether. Citigroup, Wells Fargo, Visa, PayPal and MasterCard are all reviewing the ramifications of processing financial transactions that may be deemed illegal.

Dan Forbes, a CFP Board Ambassador, is a regular contributor on financial issues. He leads the firm Forbes Financial Planning, Inc in East Greenwich, RI and can be reached at [email protected].

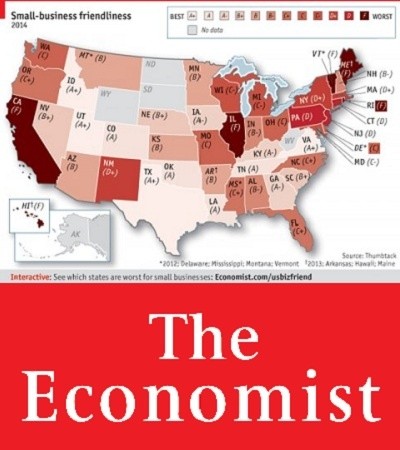

Related Slideshow: Oregon Business Rankings in US

See how Oregon stacked up against the other states in the U.S.

Related Articles

- Friday Financial Five – November 21st, 2014

- Friday Financial Five – November 14th, 2014

- Friday Financial Five – November 28th, 2014

- Friday Financial Five – November 6, 2015

- Friday Financial Five – October 2, 2015

- Friday Financial Five – May 29th, 2015

- Friday Financial Five – March 6th, 2015

- Friday Financial Five – June 5th, 2015

- Friday Financial Five – March 13th, 2015

- Friday Financial Five – March 20th, 2015

- Friday Financial Five – March 27th, 2015

- Friday Financial Five – October 23, 2015

- Friday Financial Five – October 30, 2015

- Friday Financial Five – October 9, 2015

- Friday Financial Five – September 18th, 2015

- Friday Financial Five- November 7th, 2014

- Friday Financial Five – June 19th, 2015

- Friday Financial Five – June 12, 2015

- Friday Financial Five – August 7th, 2015

- Friday Financial Five – December 12th, 2014

- Friday Financial Five – December 5th, 2014

- Friday Financial Five – February 13th, 2015

- Friday Financial Five – April 3rd, 2015

- Friday Financial Five – April 17th, 2015

- Friday Financial Five

- Friday Financial Five - August 14th, 2015

- Friday Financial Five - August 21, 2015

- Friday Financial Five - September 24th, 2015

- Friday Financial Five – February 20th, 2015

- Friday Financial Five – February 27th, 2015

- Friday Financial Five – July 17, 2015

- Friday Financial Five – July 24, 2015

- Friday Financial Five – July 31, 2015

- Friday Financial Five – July 3rd, 2015

- Friday Financial Five – July 10th, 2015

- Friday Financial Five – January 30th, 2015

- Friday Financial Five – February 6th, 2015

- Friday Financial Five – January 16th, 2015

- Friday Financial Five – January 2, 2015

- Friday Financial Five – January 23rd, 2015

Follow us on Pinterest Google + Facebook Twitter See It Read It