Friday Financial Five – March 25, 2016

Friday, March 25, 2016

Tax filing for personal returns is extended beyond the traditional April 15th deadline to April 18th. It’s important to review 1099 forms issued for non-retirement accounts to identify missing cost basis. If the custodian doesn’t have all of the information to report, capital gains for the tax year may be overestimated leading to unnecessary or incorrect tax payments. Those within the income limits to make traditional and Roth contributions might consider splitting the $5,500 maximum contribution in half to take some tax benefit now while reserving some tax benefit for retirement.

TRID has increased mortgage loan costs

Housing numbers have remained strong thanks to low rates, but the latest regulatory changes may be increasing costs to lenders. The TILA-RESPA Integrated Disclosure (TRID) has resulted in an estimated increase per loan of over $200. That comes from STRATMOR, who calculates that less than 20% of that cost can be passed along to the consumer through additional fees. Banks surveyed were meeting more headwinds adhering to the new guidelines. Generally, the regulations have resulted in a longer period of time from application to closing, but with more informed and satisfied customers.

Suggested merger of Fannie and Freddie

A most pressing mortgage issue is what to do with Fannie Mae and Freddie Mac, which are currently held in federal conservatorship. A group of experts have suggested merging the two into a single government corporation in the report: “A More Promising Road to GSE Reform." The new corporation (named the National Mortgage Reinsurance Corporation in the report) would have more flexibility, would be required to lend to underserved communities, and wouldn’t be motivated by profit. Ideally, competition would increase and the gap between large and small lenders would close. In the proposal, the Federal Housing Finance Agency (FHFA) would still retain oversight authority.

Yale endowment tax

When times are tough, the logical solution to generate tax revenue would dictate going where the money is. That’s lead to the discussion of a national wealth tax, where those above a certain net worth would face a single payment to plug the gap in entitlement spending. In Connecticut, Yale may face an “endowment tax” to help plug the $266 million shortfall for fiscal year 2016. A proposed bill would tax schools in Connecticut with over $10 billion, with Yale the sole representative in that category. The school currently gives over $8 million per year as a voluntary payment while holding an endowment of almost $26 billion.

Another professional athlete awarded financial justice

Athletes continue to be magnets for financial wrongdoing. Famous second banana, Scottie Pippen, was awarded restitution in a fraud case against a Chicago investment advisor. The advisor obtained fraudulent loans and a line of credit in the name of Pippen from Leaders Bank in Illinois. He then used the loan for his own purposes. The court ordered the advisor to pay Pippen $400,000 and Leaders Bank $1.16 million, while also slapping a three-year prison sentence on the perpetrator.

Dan Forbes, a CFP Board Ambassador, is a regular contributor on financial issues. He leads the firm Forbes Financial Planning, Inc in East Greenwich, RI and can be reached at [email protected].

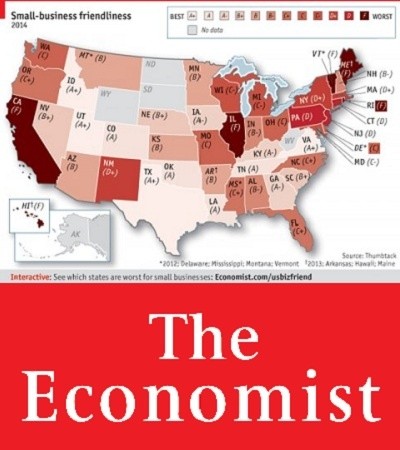

Related Slideshow: Oregon Business Rankings in US

See how Oregon stacked up against the other states in the U.S.

Related Articles

- Friday Financial Five – March 20th, 2015

- Friday Financial Five – March 18, 2016

- Friday Financial Five – March 27th, 2015

- Friday Financial Five – March 4, 2016

- Friday Financial Five – March 6th, 2015

- Friday Financial Five – March 13th, 2015

- Friday Financial Five – March 11, 2016

- Friday Financial Five – July 3rd, 2015

- Friday Financial Five – June 12, 2015

- Friday Financial Five – June 19th, 2015

- Friday Financial Five – June 5th, 2015

- Friday Financial Five – May 29th, 2015

- Friday Financial Five – November 13th, 2015

- Friday Financial Five – October 30, 2015

- Friday Financial Five – October 23, 2015

- Friday Financial Five – October 9, 2015

- Friday Financial Five – September 18th, 2015

- Friday Financial Five- November 7th, 2014

- Friday Financial Five – October 2, 2015

- Friday Financial Five – November 6, 2015

- Friday Financial Five – November 14th, 2014

- Friday Financial Five – November 20th, 2015

- Friday Financial Five – November 21st, 2014

- Friday Financial Five – November 28th, 2014

- Friday Financial Five – July 31, 2015

- Friday Financial Five – July 24, 2015

- Friday Financial Five – December 18th, 2015

- Friday Financial Five – December 12th, 2014

- Friday Financial Five – December 5th, 2014

- Friday Financial Five – February 12, 2016

- Friday Financial Five – February 13th, 2015

- Friday Financial Five – August 7th, 2015

- Friday Financial Five – April 3rd, 2015

- Friday Financial Five - August 14th, 2015

- Friday Financial Five - August 21, 2015

- Friday Financial Five - September 24th, 2015

- Friday Financial Five – April 17th, 2015

- Friday Financial Five – February 20th, 2015

- Friday Financial Five – February 26, 2016

- Friday Financial Five – January 30th, 2015

- Friday Financial Five – January 29, 2016

- Friday Financial Five – January 8, 2016

- Friday Financial Five – July 10th, 2015

- Friday Financial Five – July 17, 2015

- Friday Financial Five – January 23rd, 2015

- Friday Financial Five – January 2, 2015

- Friday Financial Five – February 27th, 2015

- Friday Financial Five – February 5, 2016

- Friday Financial Five – February 6th, 2015

Delivered Free Every

Delivered Free Every

Follow us on Pinterest Google + Facebook Twitter See It Read It