Friday Financial Five – March 11, 2016

Friday, March 11, 2016

The European Central Bank initiated more measures in hopes of stimulating growth, delving deeper into negative interest rates. The ECB will also continue its bond buying program. However, president Mario Draghi definitely stated they wouldn’t drive rates down any lower while lowering growth forecasts. This was a clear indication that the ECB is concerned about the ability of Eurozone banks to thrive in the current interest rate environment. While markets initially cheered the prospect of more stimulus, the ECB president’s cautious statements led to largely flat domestic markets for the day.

Study focuses on driver of increased wealth inequality

Central bank influence may be linked to the increase in wealth inequality across the globe, according to a report by the Bank for International Settlements. The thesis is that the ultra-low interest environment since the financial crisis created a situation where those who were already wealthy benefitted from a zero interest rate environment and inflated stock prices. Those with lower wealth, mostly tied to their homes, saw a significant decrease in home related equity followed by a recovery. The difference in growth between the wealthy’s stock and the less wealthy homeowner’s real estate equity resulted in an increasing gap in the wealth equation between haves and have-nots.

Reviewing credit card rewards programs

Credit cards make spending easy but to really maximize their use, consumers should capture spending data to track monthly expenses and pre-screen a card that will allow maximum cash back privileges. Nextadvisor provides one such comparative chart of cards that offer rewards, including providers such as American Express, Chase, and Discover. American Express tops the chart with the recently launch Blue Case Preferred®, where users can earn 6% cash back up to a cap at US supermarkets and unlimited 3% at select gas stations and department stores. Chase’s Freedom® and the Citi® Double Cash cards are also highly ranked.

401(k) plans are in favor

The number of people with a favorable opinion of the 401(k) plan increased again in 2015, according to the Investment Company Institute’s latest review. Almost three quarters of the households responding feel positively about the defined contribution plan. While that’s good news for the employers that offer the plans, it may also mean workers still aren’t entirely comfortable with the difference between defined contribution and defined benefit plans. That’s made it easier for companies to transition from one type of plan to the other, while substituting a less expensive match of employee contributions for the lifetime of income owed in the traditional pension structure.

Own a piece of the Yankees

A 1% ownership in the Yankees may be available, complete with limited input in any of the team’s operations. The asking price is based on a roughly $3 billion valuation, meaning a purchase price of roughly $24 million. The team is widely considered to be the most valuable sports team in the country, despite currently having a more closers than openers. Any transaction would have to be approved by the MLB and the Yankees.

Dan Forbes, a CFP Board Ambassador, is a regular contributor on financial issues.

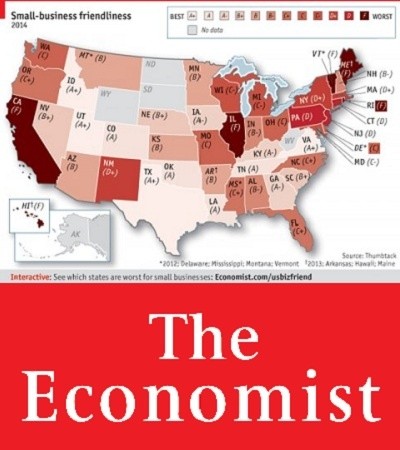

Related Slideshow: Oregon Business Rankings in US

See how Oregon stacked up against the other states in the U.S.

Related Articles

- Friday Financial Five – March 27th, 2015

- Friday Financial Five – March 20th, 2015

- Friday Financial Five – March 4, 2016

- Friday Financial Five – March 6th, 2015

- Friday Financial Five – May 29th, 2015

- Friday Financial Five – March 13th, 2015

- Friday Financial Five – June 5th, 2015

- Friday Financial Five – July 31, 2015

- Friday Financial Five – July 3rd, 2015

- Friday Financial Five – June 12, 2015

- Friday Financial Five – June 19th, 2015

- Friday Financial Five – November 13th, 2015

- Friday Financial Five – November 14th, 2014

- Friday Financial Five – October 30, 2015

- Friday Financial Five – October 9, 2015

- Friday Financial Five – September 18th, 2015

- Friday Financial Five- November 7th, 2014

- Friday Financial Five – October 23, 2015

- Friday Financial Five – October 2, 2015

- Friday Financial Five – November 20th, 2015

- Friday Financial Five – November 21st, 2014

- Friday Financial Five – November 28th, 2014

- Friday Financial Five – November 6, 2015

- Friday Financial Five – July 24, 2015

- Friday Financial Five – July 17, 2015

- Friday Financial Five – December 18th, 2015

- Friday Financial Five – December 12th, 2014

- Friday Financial Five – December 5th, 2014

- Friday Financial Five – February 12, 2016

- Friday Financial Five – February 13th, 2015

- Friday Financial Five – August 7th, 2015

- Friday Financial Five – April 3rd, 2015

- Friday Financial Five - August 14th, 2015

- Friday Financial Five - August 21, 2015

- Friday Financial Five - September 24th, 2015

- Friday Financial Five – April 17th, 2015

- Friday Financial Five – February 20th, 2015

- Friday Financial Five – February 26, 2016

- Friday Financial Five – January 29, 2016

- Friday Financial Five – January 30th, 2015

- Friday Financial Five – January 8, 2016

- Friday Financial Five – July 10th, 2015

- Friday Financial Five – January 23rd, 2015

- Friday Financial Five – January 2, 2015

- Friday Financial Five – February 27th, 2015

- Friday Financial Five – February 5, 2016

- Friday Financial Five – February 6th, 2015

- Friday Financial Five – January 16th, 2015

Delivered Free Every

Delivered Free Every

Follow us on Pinterest Google + Facebook Twitter See It Read It