Friday Financial Five – June 19th, 2015

Friday, June 19, 2015

Rand Paul calls for flat tax

Rand Paul provided his income tax vision in the Wall Street Journal, calling for what projects to a $2 trillion tax cut over 10 years through the implementation of a 14.5% flat tax. The flat tax is not an entirely new concept, but it’s an idea that never caught on in popularity for any of the other presidential candidates that have supported it. Rand Paul would completely abolish the current tax code, eliminating payroll taxes on workers, the gift tax and estate taxes. Mortgage interest and charitable giving deductions would remain.

Social Security may be worse than reported

American workers have reason to be concerned about Social Security benefits, as the program is reportedly on track to run out of money by 2033 given current conditions. But the situation may actually be worse than that, according to a Harvard study. While forecasts appear accurate up until the year 2000, more conservative assumptions may have then been abandoned in favor of less transparent, more aggressive methodologies. The analysis suggests this may have been a result of political pressure in order to make projections look more favorable.

Planning for teenage driver premiums

Families need to start preparing better for the “teenage driver” premium. According to a recent InsuranceQuotes.com report, adding teens increases cost by an average of 80%. The report lists the most expensive states to insure teens, with New Hampshire premiums jumping 115% and Rhode Island premiums jumping 102% on average. It often comes as a surprise and parents scramble, sometimes to the detriment of proper insurance coverage. Planning can help parents absorb the increase, similar to preparing for increased healthcare costs in retirement.

HSA guidelines released for 2016

With retirement and health plans shifting more toward employee oversight, it’s important to stay on top of revised guidelines. Just as employees should be aware of increases in retirement plan contributions, they should also know when they can put away more tax advantaged money into their Health Savings Account. The 2016 HSA guidelines have been released and they include increases for “Maximum out-of-pocket limits” of $100 for individuals and $200 for families. Contribution limits have increased by $100 for families as well. IRA holders are still able to make one tax free transfer from the IRA to an HSA in a 13 month period.

Fiduciary standard in tug-of-war

It bears repetition for anyone working with a financial professional. The fiduciary standard requires the professional to do what’s in the best interest of the client. It seems simple enough, but there continues to be opposing forces at work. The Financial Planning Coalition (comprised by the CFP Board, FPA and NAPFA) released a statement in support of the Department of Labor’s effort to update the 40 year old rule. All of these organizations wholly support the fiduciary standard, so this is not much of a surprise. Conversely, the Republican-led House of Representatives introduced a bill this week that would prohibit spending by the DOL to implement the rule.

Dan Forbes is a regular contributor on financial issues. He is a CFP Board Ambassador. He leads the firm Forbes Financial Planning, Inc in East Greenwich, RI and can be reached at [email protected].

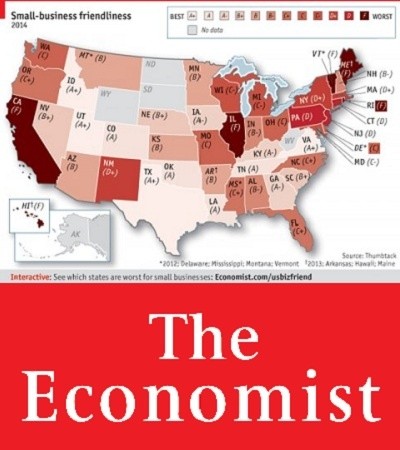

Related Slideshow: Oregon Business Rankings in US

See how Oregon stacked up against the other states in the U.S.

Follow us on Pinterest Google + Facebook Twitter See It Read It